HISPANIC BEAUTY ANALYSIS

Over the past few years, the Internet has revolutionized the way that brands gain additional exposure. It is now common for an Internet user to find a beauty brand advertisement on search engine results that seem to follow the user around virtually through the different websites and forums they visit the rest of the day. Many of these ads lead to online purchases as well as social media conversations around the products efficacy, price and other details. The OYE! Intelligence platform was recently used to conduct a Hispanic beauty analysis of drugstore and high-end cosmetic brands, examining which brands Hispanics prefer, along with which have the most foot-traffic on social media and the web at large.

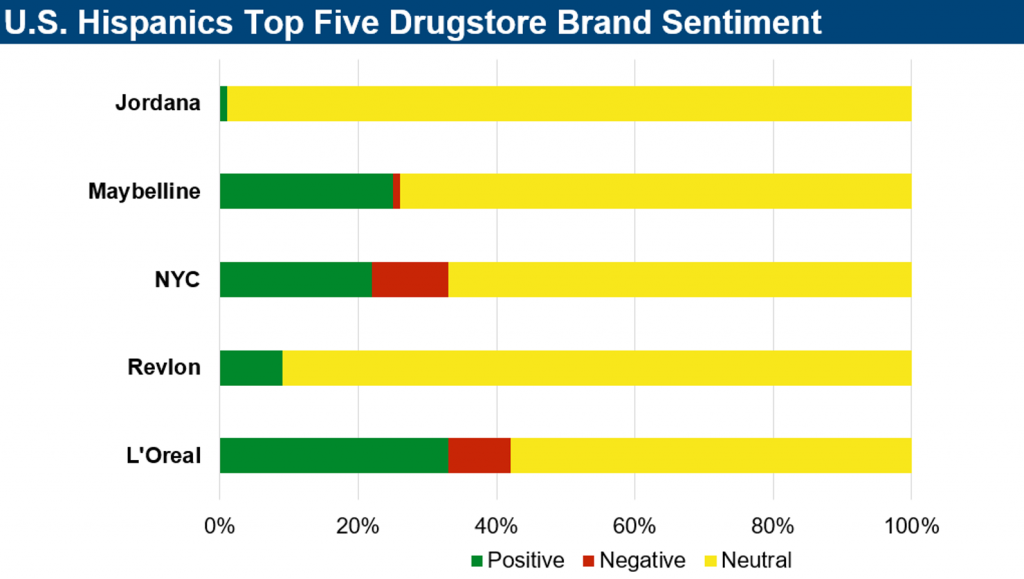

CONVERSATION VOLUME AND SENTIMENT : DRUGSTORE BRANDS

The analysis found that Jordana and Maybelline were the most popular drugstore brands among Hispanics, while Maybelline and NYC were most popular among Non-Hispanics. The data also showed that among the top 5 Hispanic brands, positive sentiment is highest towards L’Oreal and Maybelline. Notably NYC led negative sentiment with 11%. While Jordana held the most neutral sentiment across analysis, this brand as well as Revlon had zero negative conversation during the time period.

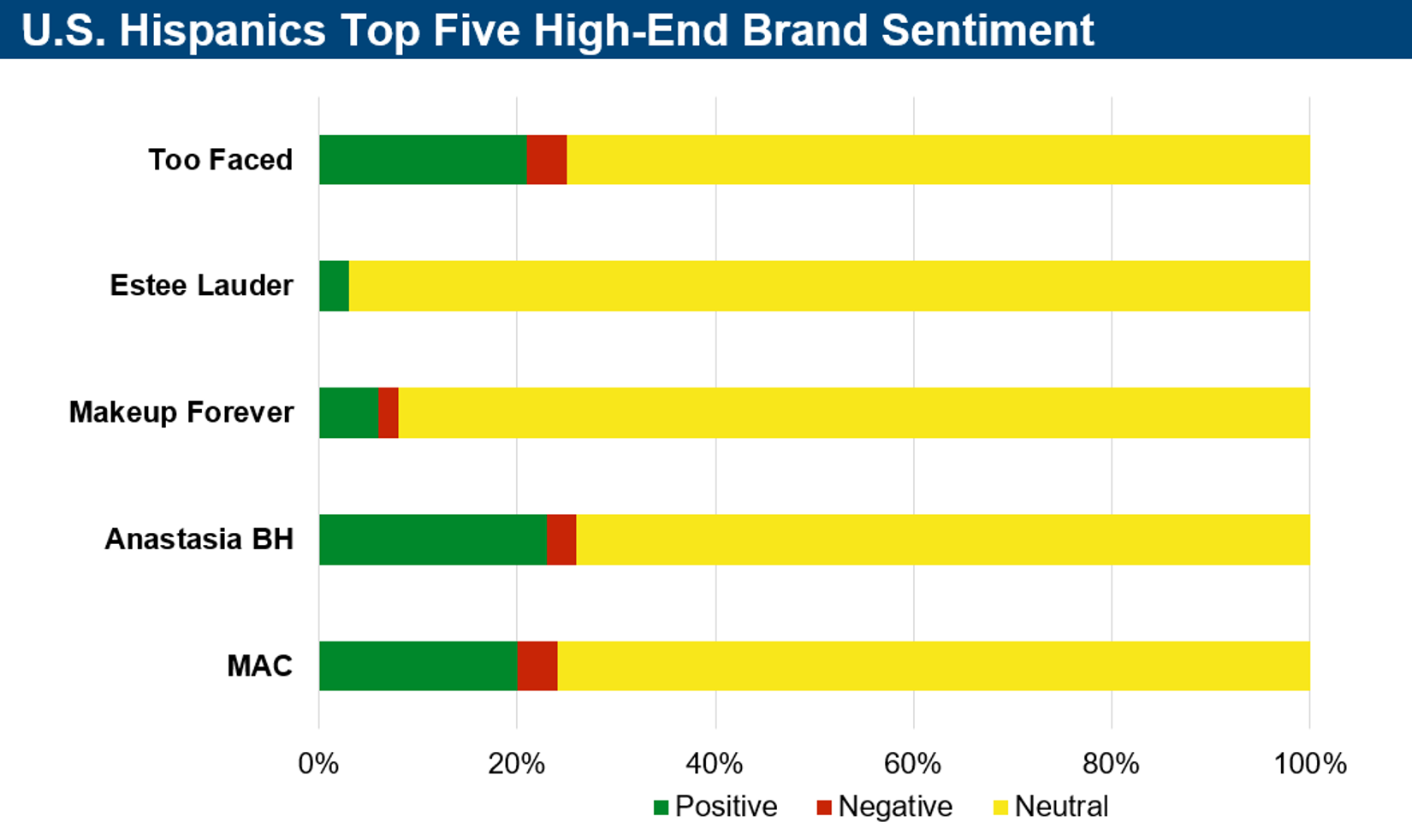

CONVERSATION VOLUME AND SENTIMENT: HIGH-END BRANDS

MAC Cosmetics commanded by far the greatest conversation volume among Hispanics compared to other high-end brands. This was also true for Non-Hispanics. Although low in Hispanic conversation volume relative to MAC, Makeup Forever had the highest Hispanic proportion at 56%, followed closely by Estee Lauder at 54%. Anastasia Beverly Hills had the highest positive sentiment among Hispanics followed by Too Faced with the second most.

DOWNLOAD FULL REPORT

Download the full Hispanic Beauty Analysis using the form below to get instant access to OYE! Hispanic insights.

[contact-form-7 id=”189295″]

METHODOLOGY

This analysis covers what 2,421 verified US Hispanics discussed online about drugstore and high-end cosmetic brands. Included in the Hispanic Beauty Analysis, is an examination of which brands Hispanics prefer and which brands receive the most mentions via online channels such as Twitter, Blogs, Forums, and the web at large.

ABOUT OYE!

Want to learn more about how OYE! produces these Hispanic insights? Send an email to info (@) oyeintelligence.com and we will contact you promptly.