HISPANIC NUTRITIONAL SUPPLEMENT ANALYSIS

Being healthy and looking fit is a point of pride that most people work on at one point or another. Over the past few decades, many companies have catered to the health-conscious market by promoting nutritional supplements. The OYE! Intelligence platform was recently tasked to gauge the latest conversation trends in the industry and provide insights into what Hispanics currently discuss about several of the brands that are readily available across the U.S. marketplace. The following Hispanic Nutritional Supplements Analysis is a comparative study that provides a review focused on 5 brands; Bayer, GNC, Herbalife, Nutrilite, and Omnilife.

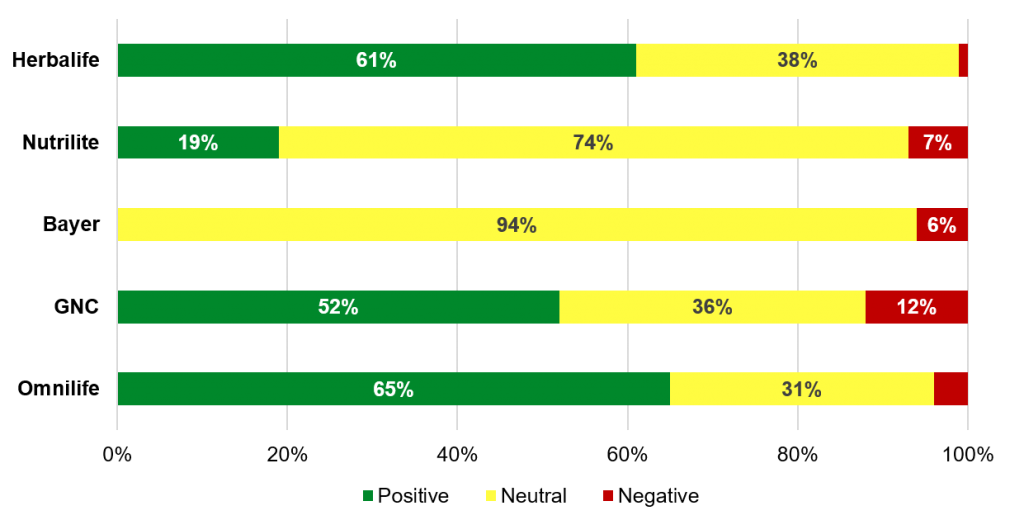

SENTIMENT

SENTIMENT

The analysis showed that Herbalife had the largest volume of conversations in the total market overall (see full case study link below) and also had the second-highest Hispanic proportion. Nutrilite, with 28% Hispanic proportion, led all five brands reviewed in that category. Omnilife, which is a brand focused on the Mexican market, had the lowest total mentions overall among U.S. Hispanics, but had the highest positive sentiment at 65%, with Herbalife coming in second at 61%. GNC had the highest negative sentiment at 12%, driven by consumer reviews of products and mentions of poor experience in-store.

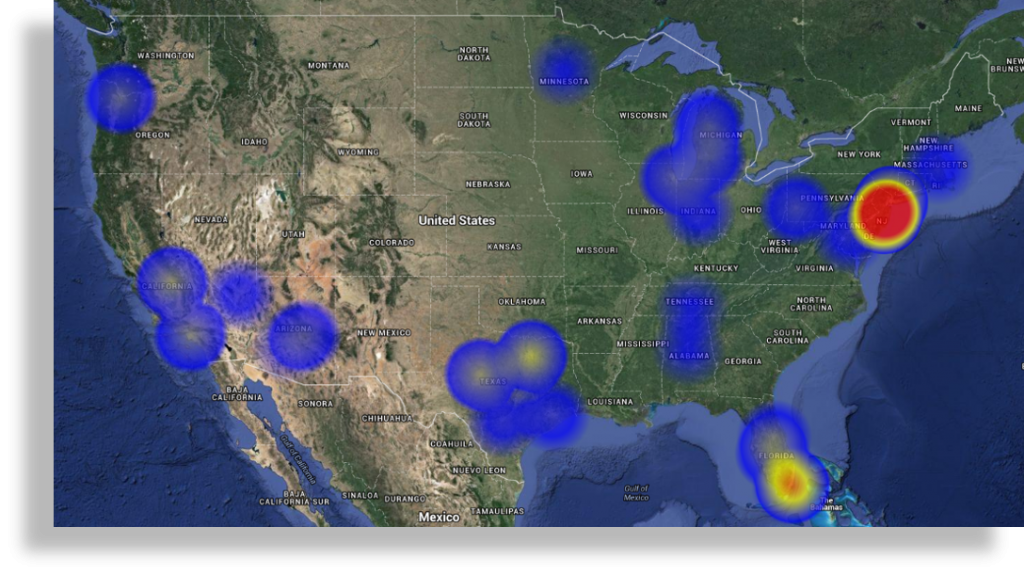

GEO-LOCATION

GEO-LOCATION

Conversation among U.S. Hispanics had the largest volume on the east coast, focused in New Jersey. Conversation also had a significant presence among Hispanics that reside in California, Florida, New York, and Texas. Overall, the top three states leading in Hispanic mentions were New Jersey with 26% of the conversation, followed by Florida at 17% and Texas at 13%.

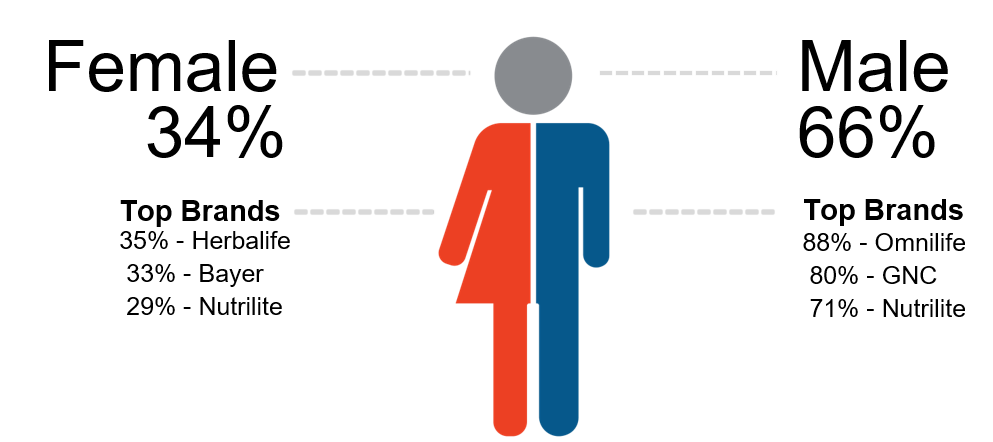

GENDER ANALYSIS

GENDER ANALYSIS

Men led in overall conversation regarding supplements, with Omnilife having the highest proportion of male conversation at 88%, followed by GNC at 80%. Herbalife led the female conversation with 35%, trailed by Bayer closely behind at 33%.

METHODOLOGY

This analysis covers conversations from 3,153 verified US Hispanics regarding the topic of nutritional supplements, examining which brands are most popular amongst Bayer, GNC, Herbalife, Nutrilite, and Omnilife. All data was collected from May 1, 2016 – May 31, 2016.

FULL REPORT

Download the full Hispanic Nutritional Supplements Analysis via the form below to get instant access to OYE! Hispanic consumer insights including expanded coverage on the topics mentioned above as well as Share of Voice, language preference, social channels, as well as insights and consumer examples.

[contact-form-7 id=”189297″]

ABOUT OYE!

Want to learn more about how OYE! produces these Hispanic insights? Send an email to info (@) oyeintelligence.com and we will contact you promptly.